Form DF-6 free printable template

Show details

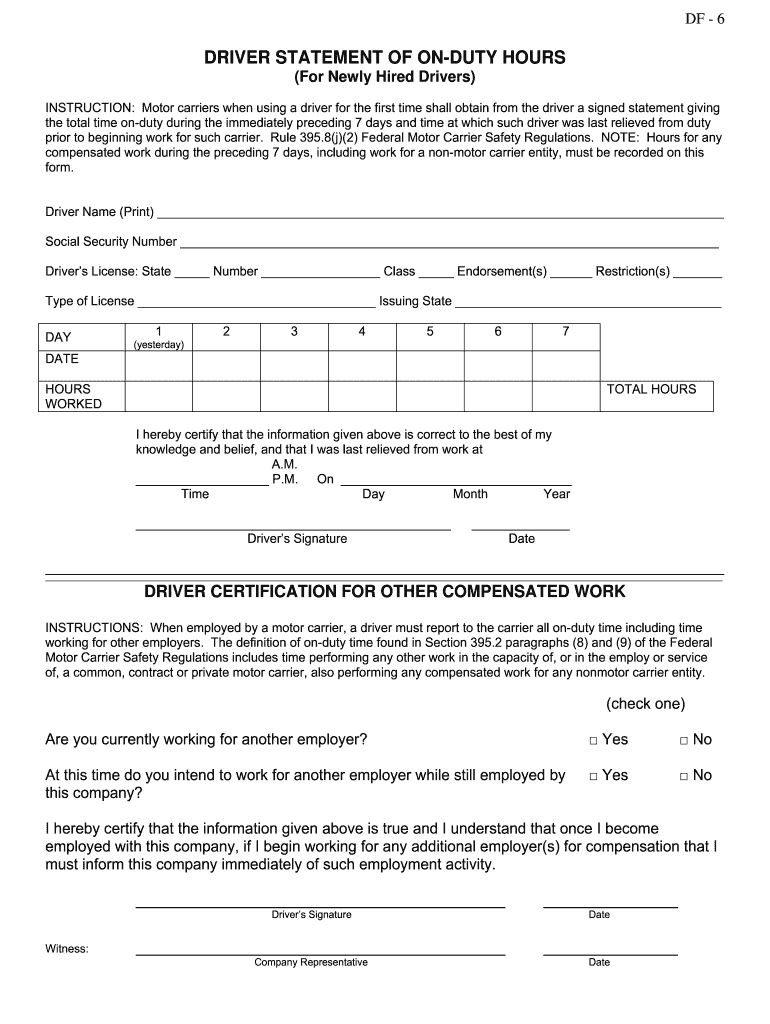

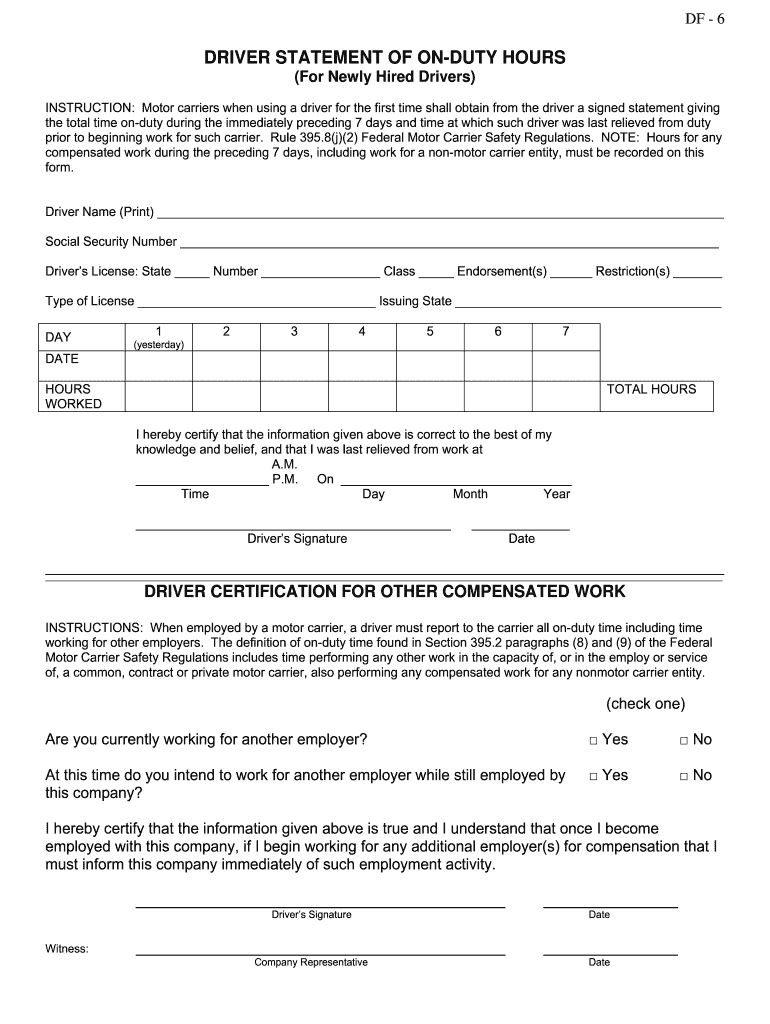

DF - 6 DRIVER STATEMENT OF ON-DUTY HOURS For Newly Hired Drivers INSTRUCTION Motor carriers when using a driver for the first time shall obtain from the driver a signed statement giving the total time on-duty during the immediately preceding 7 days and time at which such driver was last relieved from duty prior to beginning work for such carrier. Rule 395. 8 j 2 Federal Motor Carrier Safety Regulations. NOTE Hours for any compensated work during the preceding 7 days including work for a...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign driver statement of on duty hours form

Edit your record of duty status form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fmcsa drivers time record form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 7 day prior log form online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit df 6 driver statement of beginning work for such carrier form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hours of service form

How to fill out Form DF-6

01

Obtain Form DF-6 from the appropriate authority or website.

02

Fill in your personal information in the designated fields, including your name and contact information.

03

Provide the relevant details required for the application, following the instructions on the form.

04

Attach any necessary supporting documents as indicated on the form.

05

Review the completed form for accuracy and completeness.

06

Sign and date the form in the specified area.

07

Submit the form according to the guidelines provided, whether by mail or online.

Who needs Form DF-6?

01

Individuals or organizations applying for a specific permit or license related to the use or possession of controlled substances.

02

Professionals requiring authorization for activities governed by regulations involving controlled materials.

03

People seeking to document compliance with state or federal requirements pertaining to substance management.

Fill

driver statement of on duty hours form

: Try Risk Free

People Also Ask about line of duty form

What is on duty time as stated in the Fmcsa?

Any time beyond 2 hours spent in a passen- ger seat on a moving property-carrying CMV immediately before or after you spend 8 con- secutive hours in a sleeper berth. If you do not rest in a sleeper for 8 hours, then ALL time in a passenger seat on a moving vehicle is on duty.

How many hours can a local CDL driver work in a week?

60/70-Hour Limit May not drive after 60/70 hours on duty in 7/8 consecutive days. A driver may restart a 7/8 consecutive day period after taking 34 or more consecutive hours off duty.

What is short haul exception in trucking?

Overview: What is the short-haul exemption? The short-haul exemption governs how some fleet companies might be exempt from using electronic logging devices (ELDs) to track their drivers' activities. Additionally, drivers who use the ELD timecard exemption are not required to keep records of duty status (RODS).

Which task would be included in the definition of on duty time?

The bottom line is that on-duty time includes all time you are working for a motor carrier, whether paid or not, and all time you are doing paid work for anyone else. The definition of on-duty time is found in Section 395.2.

How does the 16 hour rule work?

The 16-hour rule is a special exemption that allows specific drivers to remain on-duty for 16 hours instead of 14, but without extending the allowed 11 hours per day of driving. This exemption applies to drivers that have started and stopped their workdays at the same location for the previous five workdays.

Which of the following qualifies a driver for the short haul exemption?

CDL drivers qualify as short-haul if you: drive only within a 150-air-mile radius. do not drive more than 11 hours at a time. maintain time-clock function.

What is the meaning of duty time?

Related Definitions On duty time means all time from the time an employee begins to work or is required to be in readiness to work (reporting time), until the time the employee is relieved from work and all responsibility for performing work (quitting time).

Why did the government establish hours of service regulations for the trucking industry?

The rules came into being in the 1930s as a combination of labor and economic regulation intended to bring some stability to the nascent trucking industry, and to protect workers from overly demanding employers.

How many hours can a truck driver drive per week?

Weekly hours In any given week a driver can drive for no more than 56 hours. However, drivers are not permitted to drive for more than 90 hours over the course of two weeks so if a driver reaches the 56-hour maximum in one week then the weeks preceding and proceeding that week must not exceed 34 driving hours.

What is the Fmcsa short haul exemption?

What Is the Short-Haul Exemption? The short-haul exemption is an exemption from rules requiring fleet management companies to track their drivers' activity using an ELD (electronic logging device).

How do you use 16 hour short haul exception?

It is your “workday,” the time between your off-duty periods of at least 10 consecutive hours. You must be released from duty within 16 hours after coming on duty. You must only use this exception once every 7 consecutive days (unless you took 34 consecutive hours off to restart a 7/8-day period).

What are the hours of a local truck driver?

Drivers have a 14-hour window to drive a maximum of 11 hours. They are required to take a 30-minute break after eight hours of driving. With the 14-hour rule, drivers cannot drive after the 14th consecutive hour they are on duty until they take 10 hours off duty.

What's the purpose of the Fmcsa's hours of service regulations?

“Hours of service” refers to the maximum amount of time drivers are permitted to be on duty including driving time, and specifies number and length of rest periods, to help ensure that drivers stay awake and alert.

How many hours can a local CDL driver drive?

Drivers are allowed to extend the 10-hour maximum driving time and 15-hour on-duty limit by up to 2 hours when adverse driving conditions are encountered.

What is on duty time in Canada?

A driver must have 10 hours off-duty in a day. A driver cannot drive more than 13 hours in a day. A driver cannot drive after 14 hours on-duty in a day.

What's the purpose of the Fmcsa's hours of service regulations quizlet?

Hours of service regulations are in place to prevent driver's from operating motor-vehicles under fatigue. Fatigued driver's are more likely to be in a crash.

Which task would be included in the definition of off duty time?

Typical off-duty activities include stopping for meal breaks, rest breaks and sleep. If a driver is waiting to be assigned work by a motor carrier (i.e., at home or some other location carrying a pager/beeper), it is considered off-duty time.

Which tasks would be included in the definition of on duty time?

On-duty time includes all time you are working or are required to be ready to work, for any employer, whether paid or unpaid. If you are working or obligated to do something or be somewhere for a motor carrier, whether paid or not, OR are doing paid work for anyone else, you are on duty.

How do you use short haul exception?

In essence, the short-haul exemption is a limited regulatory exemption available to commercial drivers who operate exclusively within a 150 air-mile radius of their normal work reporting location and who are released from duty from that location no later than 14 hours after they start working on a given day.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the fmcsa short haul time sheet pdf form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign driver duty slip. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I complete record of duty status on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your records of duty status. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I complete truck driver paperwork on an Android device?

Use the pdfFiller mobile app and complete your fmcsa driver record and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is Form DF-6?

Form DF-6 is a document used for reporting certain financial transactions involving foreign entities to comply with U.S. Department of Treasury regulations.

Who is required to file Form DF-6?

Individuals and businesses that engage in specific foreign financial activities or transactions that meet certain thresholds are required to file Form DF-6.

How to fill out Form DF-6?

To fill out Form DF-6, gather all necessary financial information related to foreign transactions, complete each section of the form accurately, and submit it by the designated deadline.

What is the purpose of Form DF-6?

The purpose of Form DF-6 is to ensure transparency and regulatory compliance regarding financial transactions with foreign entities, helping the U.S. government track foreign investments.

What information must be reported on Form DF-6?

Form DF-6 must report details such as the nature of the transactions, parties involved, amounts, dates, and any relevant identification numbers associated with the foreign entities.

Fill out your Form DF-6 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Reporting For Duty Meaning is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.